Ontario’s $1,500 Heat Pump Rebate Explained (2025 Update)

Liby Thomas

Published on: Nov 06, 2025

Liby Thomas

Published on: Nov 06, 2025

Heat pumps are quickly becoming one of the most popular heating and cooling options in Ontario thanks to their energy efficiency and year-round comfort. Instead of generating heat, a heat pump transfers it meaning you use significantly less energy compared to a traditional furnace or baseboard system. This reduces both your utility bills and your home’s carbon footprint.

To encourage homeowners to make the switch, Ontario introduced a new rebate program in 2025 known as the Home Renovation Savings (HRS) Program. This initiative is part of a $10.9 billion investment in energy efficiency, offering rebates for multiple upgrades, including insulation, thermostats, and heat pumps.

For most Ontario homes, the rebate for installing a heat pump is approximately $1,000 to $1,500, depending on the size of your system and your heating type. In this guide, we’ll explain exactly how the $1,500 heat pump rebate works, who qualifies, and what steps you need to take to apply.

Ontario’s New Home Renovation Savings (HRS) Program

Launched on January 28, 2025, the Home Renovation Savings (HRS) program replaces the previous Home Efficiency Rebate Plus (HER+) program, which stopped accepting new applicants earlier that year. The HRS program is jointly delivered by Enbridge Gas and the Independent Electricity System Operator (IESO), with support from the Government of Ontario.

The goal is to create a “one-stop” system for home energy rebates simplifying how homeowners apply and helping them get faster access to funds. If your home is heated by natural gas or electricity, you’re likely eligible for significant savings when you upgrade to a qualifying cold-climate air-source heat pump.

How Much is the Heat Pump Rebate?

The rebate amount depends on your heating fuel and heat pump capacity (size):

- Gas-heated homes: $500 per ton of heat pump capacity, up to $2,000 maximum.

Example: A 3-ton heat pump system would earn you $1,500 back. - Electrically heated homes: $1,250 per ton, up to $7,500 maximum.

Example: A 3-ton heat pump earns $3,750 in rebates.* - Ground-source (geothermal) systems:

Gas-heated homes: Flat $3,000 rebate

Electrically heated homes: $2,000 per ton, capped at $12,000 total

Most Ontario homes fall in the 2–3 ton range, meaning a $1,000–$1,500 rebate is common for gas-heated homes. Electrically heated homes receive more, as the rate per ton is higher.

No Energy Audit Required

One of the biggest advantages of the new HRS program is that you no longer need to complete a pre- or post-retrofit energy audit to qualify for the heat pump rebate. This change makes the process faster and simpler, especially for homeowners replacing an older furnace or looking for immediate savings.

For those planning multiple upgrades, such as insulation or new windows, an energy audit can still be beneficial but it’s no longer mandatory for single upgrades like a heat pump installation.

Who is Eligible for Heat Pump Rebate?

To qualify for the HRS heat pump rebate, homeowners must meet the following conditions:

- The home must be located in Ontario and connected to either Enbridge Gas or the provincial electricity grid.

- The current heating system must use natural gas or electric resistance (baseboards or furnace).

- Homes heated by oil or propane are not eligible under HRS at this time.

- Only low-rise residential homes (detached, semi-detached, townhouses, or mobile homes with permanent foundations) qualify.

- High-rise condos and new construction homes are not eligible.

- The applicant must be the homeowner — tenants cannot apply directly.

- Homes that have already received rebates through previous Enbridge or Save on Energy programs (like the Greener Homes or HER+ grants) cannot apply again.

- All systems must also be on the Natural Resources Canada (NRCan) approved product list, ensuring that only certified high-efficiency heat pumps qualify.

How to Apply for the $1,500 Heat Pump Rebate?

The HRS program is designed to be simple and contractor-driven. Here’s how it works:

- Find an HRS-registered contractor: Only approved contractors can submit applications on your behalf. They’ll confirm your eligibility and guide you through the process.

- Get an assessment and quote: The contractor evaluates your home, recommends the right heat pump size, and submits your rebate application for pre-approval.

- Wait for approval: Most applications are reviewed within 2–3 business days. Once approved, your rebate funds are reserved.

- Install your new heat pump: Your contractor completes the installation and ensures everything meets HRS program standards.

- Receive your rebate cheque: After final verification and submission of paid invoices, you’ll receive your rebate directly by mail.

Unlike instant discounts, rebates are refunded after installation — so you pay upfront and get reimbursed once the work is complete.

Optional: Bundle with Other Upgrades

If you want to combine multiple energy improvements, the HRS program allows “bundled upgrades.” For example, you can add insulation, window replacements, or a smart thermostat and qualify for additional rebates.

The program even reimburses $600 for the cost of an energy audit if you choose to go this route. Homeowners can stack multiple upgrades to maximize savings, though the maximum rebate for each individual item (like a heat pump) still applies.

Conclusion

Ontario’s $1,500 heat pump rebate is an excellent opportunity for homeowners to make their homes more efficient and comfortable while cutting heating costs. With no energy audit required, fast approvals, and rebate amounts that cover a meaningful portion of your installation cost, there’s never been a better time to make the switch.

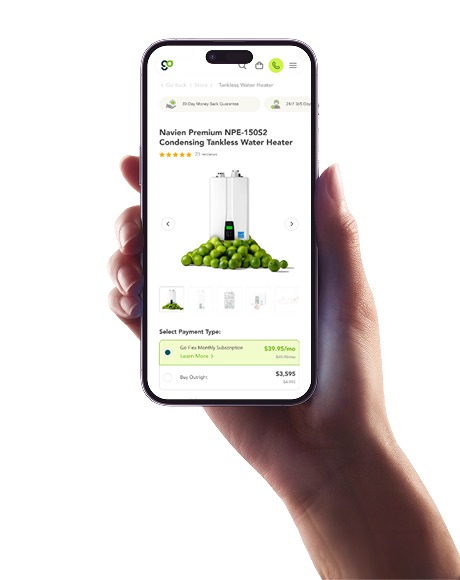

If you’re ready to upgrade your home’s comfort and energy efficiency, reach out to a registered contractor like Go Lime to explore your options. Whether you want to buy or subscribe through Go Flex, our team will handle every step, from system sizing to rebate paperwork, ensuring you receive your full rebate.